At Valuist we often put broad financial topics under the microscope to provide in-depth analysis and hopefully, determine where the value can be found. But sometimes the most impactful articles are the ones that provide easy-to-digest tips on a range of pertinent topics. So, for this post, I am going to revisit some of the most important money lessons that I have learned writing for Valuist.

Because we previously covered, 15 Money Mistakes You Can’t Afford to Make, as well as, 5 More Money Mistakes, let’s take a look at the other side of the coin, money habits that you should cultivate to increase your net worth over time.

Ten money habits that are guaranteed to increase your net worth and preserve your wealth

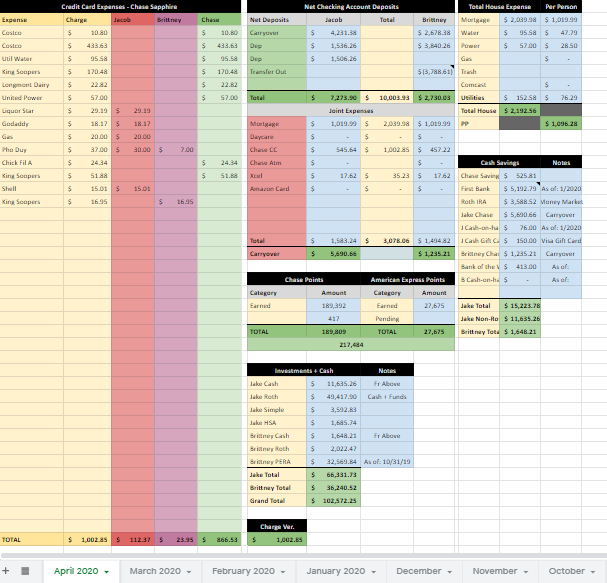

1. Track your spending and investments

It’s hard to plan where you’re heading if you don’t know where you have been. Having all of your finances in one easy-to-review format will make you more aware of, and help you analyze, your earnings, spending and savings rate. I went a little crazy with budget tracking for a while. I was using Mint, Personal Capital and a series of spreadsheets to track my family’s personal finances, so I decided to simplify. I realized that as long as I can see what is coming in, what’s going out, and how much is being saved I am doing enough.

Fortunately, Valuist has you covered too! I released the same excellent free budgeting spreadsheets and our awesome investment tracking and asset allocation tools , which I have been improving for years.

2. Prioritize your savings

Most people are vaguely aware of a need to save, but far fewer know the best way to allocate their savings. Valuist covered this topic in detail here but the important bullet points are best summarized with this infographic:

3. Understand the true value of things (maximize value)

How to maximize value in your purchases is crucial. Many people assume that more expensive equates to better, but the truth is that the best values are often found between the extremes. Understanding the true cost of buying a home and what you should expect when purchasing a car are probably the most important lessons because these purchases are typically the biggest expenditures people make. However, once you start thinking as a Valuist, you naturally begin to apply the value filter to just about everything.

4. Negotiate pay increases throughout your career

Career stagnation significantly and permanently reduces your future net worth. That’s why you owe it to yourself to get paid what you are worth. Valuist thoroughly covered this topic but in summary you should always strive for the following, whenever possible:

- Do something you have an interest in

Doing what you “love” is rare and often intangible, so just liking whatever you are doing is good enough. - Demonstrate your value

As cliched as it is, if you dedicate yourself to being the best at whatever you are doing, you will be recognized. Employers are focused on profits and profits are derived from human capital, what people can accomplish when properly empowered. - Leverage your value

You can’t fake your value and employers recognize it when they see it. However, they are not necessarily going to offer you a raise out of the blue. Asking for a pay increase is not only reasonable, it’s usually necessary in the for-profit sector. You can learn an extraordinary amount of information online about the average salaries in your field and region on sites like Glassdoor. Or, you could secure other job offers to gauge your current marketability and use a (firm) offer for employment to leverage a pay raise with your current employer. This is done far more often than you might think, but this strategy requires a lot of legwork and you should only attempt it if you are actually willing to accept an outside offer for employment, in case the plan back fires.

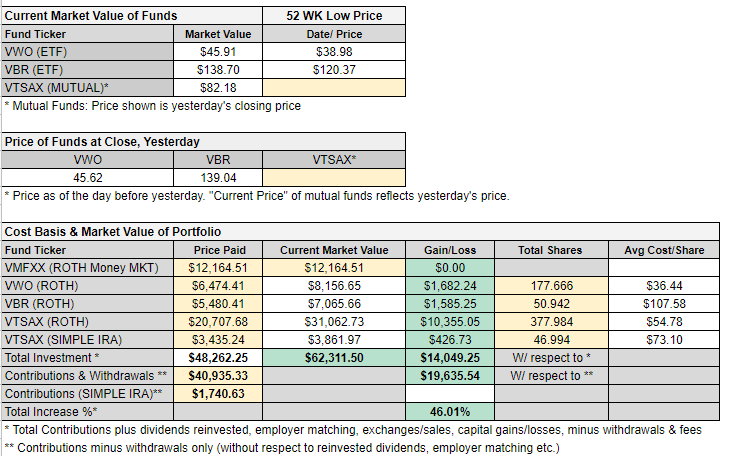

5. Invest early and aggressively in equities that align with your risk tolerance

In the accumulation phase of your investment life, nothing beats the risk-adjusted returns of stocks and mutual funds. Unlike real estate, you can almost always afford some amount of stock shares and they require no maintenance, HOA dues, property taxes, utilities, repairs or renovations. You can easily shelter stocks from tax and, if you’re broadly diversified and have enough time to wade through bear markets, you can virtually guarantee excellent long term returns. Investing can be incredibly complex, especially if you are trying to pick individual stocks, but Valuist has outlined one really simple, effective and risk-adjusted method to invest in index funds.

Related: You actually can shelter real estate from taxes, through a self-directed retirement account

6. Buy Good Real Estate

We have evaluated both sides of this topic, some of the benefits of renting as well as the benefits of home ownership. And actually, either option may make the most financial sense depending on where you live, your lifestyle and your age. However, it cannot be denied that owning real estate is one of the easiest and most common ways to increase your net worth over time. That’s because the equity you are paying now tends to follow you for life and eventually, you will (hopefully) end up with a fully paid-off piece of property which you can leverage, sell or simply live in for little cost.

7. Learn how to do things

Sure, there are always tasks you should always hire-out, like anything legal or construction related if that’s not in your wheelhouse. But, there are a ton of things you can learn to do that will save you money without a huge dedication of time.

Here are some things you can do for yourself to save money:

- Clean your own car and home

- Manage your own finances and resolve some tax debt

- Home maintenance (mowing, weeding, shoveling, painting and some repairs)

- Pest control

- Interior design and decorating

Here are some things that probably wont save money:

- Coupon clipping, BOGO deals and Black Friday

- Buying in bulk

- Attempting construction projects yourself (if you’re not an expert)

- Personal legal representation, trying to resolve complex tax debt

- Aggressively paying off your house in a low interest environment, or when you have other debt.

8. Unleash the power of excellent credit

Personal finance novices cut up their credit cards; Valuists leverage the power of excellent credit to significantly increase their net worth over time. That’s because with excellent credit you get the best home and vehicle loans, which, aside from business loans, are probably the only things you should ever borrow money for.

Another perk of excellent credit is the loyalty rewards points. You can use these to fund plane tickets, hotel stays, shop and much more.

9. Withhold less from your paycheck and other tax tips

By over withholding you are unnecessarily reducing the money you have to invest or otherwise spend throughout the year. The only benefit to over-withholding taxes is to avoid a potential bill at the end of the year. Also, most people seem to think that their tax return is some kind of bonus, rather than an interest free loan you give to the government. You can just about break even if you complete your W4 the right way.

10. Evaluate your money mindset

Perhaps the most important personal finance habit to develop is the cultivation of a strong money mindset. By that, I mean prioritizing earning, saving and investing above frivolous spending. A strong money mindset also means not side-hustling your way into an 80 hour work week. Can money buy happiness? Sure, but only for so long, because time is the most valuable resource we get. If you focus on amassing just enough wealth to provide a good life for yourself and your family, and you can do that without sacrificing your time, then you can possibly find the middle ground. That’s where the value is.