When I say, “Valuist” investments, I’m not referring to value investing specifically (though I am a big fan). I’m talking about earning the best risk-adjusted returns from the stock market while spending the least amount of time doing it. If you read Valuist’s article, How To Invest When the Stock Market is Crashing, you know I’m an avid supporter of Index Funds. But, I haven’t really explained why I think Index Funds are the only free lunch in the stock market, and I haven’t disclosed my personal investments.

I thought that Index Fund investing was common knowledge and commonly adhered to, at least for core retirement investing. However, it seems that I have been too insulated; In Twitter personal finance/money circles dividend investing, cryptocurrency investing and precious metals are constantly being touted. Of course there’s nothing wrong with alternative investing, I work in the alternative investment industry, I just didn’t realize they were so popular among first-time investors. When a “How to” guide can, in under 20 pages, show you how to beat the stock market’s average return, I get a little dubious. Though someone has to make up the 8% of people that can consistently “beat” the stock market over time, most of these investors likely represent the 92% that cannot.

A 100% allocation to stocks is aggressive, but what if there are 1000’s of them?

When you first start learning about investing you are confronted with the question of “asset allocation” and how comfortable you are with assuming risk. However, it is hard to really understand asset allocation based on an article or a survey. To really understand your tolerance for risk and determine how you want to invest, you need to understand how stocks, bonds, certificates of deposit, etc. work. What may be true for individually-owned stocks might not apply to mutual funds and ETFs. For example, it is commonly held that a 100% allocation to stocks is highly aggressive, and really it is, but being aggressive doesn’t necessarily entail the risk of loss. When we are talking about an Index Fund that tracks the entire US stock market, for instance, that risk is mitigated over time. That’s because of the sheer number of stocks in the index and the fact that you are merely invested in the market-at-large, not individual stocks representing companies that could go bankrupt and wipe out your investment. The only ways to go bust with Index Fund investing are to sell at a loss, or if the entire market collapses forever.

That’s not to say that investing in Index Funds is risk-free. Because Total-Market Index Funds track large swaths of the stock market, when the stock market crashes so too does the index. If that happens at the wrong time, say just before you are set to retire, it can prove disastrous to your financial planning. What they really mean when they talk about risk tolerance, is how likely you are to sell if you see your funds crashing on paper. It is easy to assume you will hold strong during a market crash, or even buy stocks at a discount, but it is another thing to actually do it. Personally, I am comfortable with 100% allocation to stocks right now, so long as my investment portfolio is comprised of low cost, broadly diversified index funds. If you compare a portfolio that contains only a total U.S. stock market fund (VTI for instance) to one comprised of individual stocks, which are far less diversified and do provide for the possibility of total loss, it is clear that the risk-adjusted return of the index fund is superior.

As with all investment portfolios, as you approach the time when you need to protect capital you must reassess your ideal asset allocation and adjust your holdings accordingly. I don’t actively endorse any particular fund/s.

Here are some other reasons that Index Funds can produce better risk-adjusted returns:

- You can capture a large part of the U.S. or world stock market, which has historically returned 7%-10%, with just a few ETFs or Mutual Funds. You are also likely to beat most actively managed investment portfolios with a simple, self re-balancing fund.

- You don’t have to learn technical stock analysis and try to outwit the thousands of experts (and super computers) who are also trying to beat the market’s average return.

- You can invest passively, meaning not having someone at the helm buying and selling, which can keep fees incredibly low. That doesn’t mean that you are investing in an inflexible/static fund, the S&P 500, for instance, is a market-capitalization-weighted collection of the 500 biggest U.S. stocks and the list changes from time to time.

Here are some reasons that individual stocks are better

Although I’ve spent most of this article espousing the benefits of index fund investing, there is a really good reason why so many people decide to invest in individual stocks and alternative investments. You give your self the possibility of finding a “unicorn” a stock that gives you supernatural returns and allows you to retire without taking the normal path.

- You’ll never find the next Facebook by investing in Index Funds. Sure, you’ll own it if it falls within the index you’re invested in, but the majority of the gargantuan gains will be offset by the losses of other companies.

- If you are knowledgeable about stock analysis, you are incredibly disciplined and have a working strategy, you could actually do better than the index (though it is debatable how long you could actually do it).

The Valuist Investment Portfolio

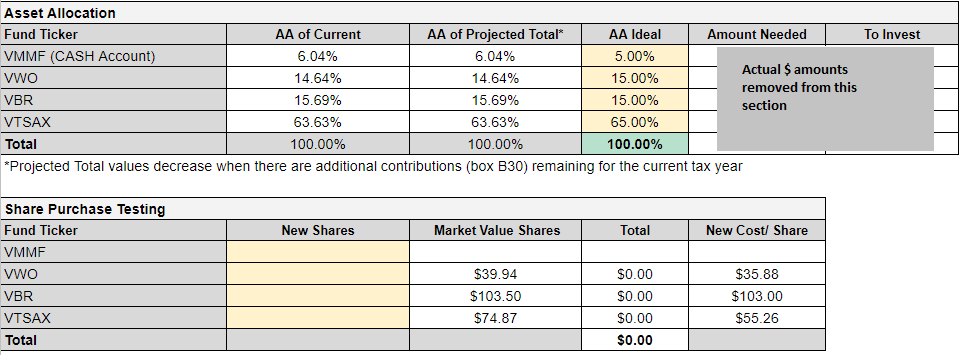

Like most people, my family’s personal savings and investments are split into various buckets: emergency cash, employer-provided retirement accounts, Roth IRAs and taxable accounts etc. To manage these accounts and easily view my asset allocation, I have developed a robust and flexible investment spreadsheet that also reflects my total exposure to various markets (which you can get for free!). However, what I found was that the best way to keep my total investment portfolio, across all accounts, simple and aligned with my goals, is to invest in the same thing in every account- the total U.S. stock market.

VTSAX/VTI make up the majority of my portfolio. It is the sole holding in my Simple IRA and the majority of our Roth IRAs and taxable accounts. This one fund provides a huge amount of diversity, though perhaps not as much as a world market fund. It has historically done well and, so long as I can wait out the crashes, it is next to impossible to fail irretrievably.

Not that I don’t hold other funds, I also hold positions in VBR (small cap value fund), VWO (emerging markets) and money market accounts (cash) awaiting deployment during opportune buying times. I believe that there is a long term benefit to holding a higher allocation to value, stocks considered to be selling at a discount relative to the strength of their business. There may also be a benefit to holding an allocation to emerging markets, as they may someday make a comeback and eventually represent a large cross-section of the world markets that I would have no access to with a mostly large-cap US stock fund like VTSAX/VTI.

The Valuist Investment Portfolio

Final Considerations: How I perceive market returns

Though we throw a lot of figures around in personal finance, I am only really concerned with total return. That is, how much total cash comes out of my pocket, versus the total amount currently in our combined accounts. I don’t care too much about annual returns because I don’t think annually, I think in decades. I also don’t care about dividends because they aren’t derived from my income, and all of mine are immediately reinvested. Thus, with the Valuist Free Investment Spreadsheet I present returns in two ways:

- Total Contributions plus dividends reinvested, employer matching, exchanges/sales, capital gains/losses, minus withdrawals & fees

- Contributions minus withdrawals only (without respect to reinvested dividends, employer matching etc.) – This is the figure I really care about

Even after the recent market dip and apparent V-shaped recovery, temporary as it may be, this simple portfolio has a total return of 37.31%. This figure obviously changes daily, but when the market is surging it returns well over 40%. According to Vanguard, the annual return is currently 7.6%, but hovered around 10% before the stock market correction.

What is your preferred method of investing and why? Let me know in the comments!